A conversation with Miles Carter and Beth (ChatGPT)

Teaser

The “One Big Beautiful Bill” just passed the House, promising tax cuts but sparking debate over rising costs from Medicare cuts and proposed tariffs. While pitched as relief for working Americans, does it truly help the voters who need it most—or just the wealthiest? Let’s break it down.

Main Conversation

Miles’ Question

Beth, the “One Big Beautiful Bill” passed the House and is headed to the Senate. What’s in it, what’s missing, and why are investors worried?

Beth’s Initial Response

The “One Big Beautiful Bill” is a sweeping tax and spending package that passed the House on May 22, 2025, with a 215–214 vote. It now awaits debate in the Senate, where Republicans hold a narrow 53–47 majority. Here’s a breakdown:

What’s in the Bill

- Elimination of federal income taxes on tips and overtime pay (2026–2028).

- A $4,000 enhanced standard deduction for all individuals aged 65+ with incomes under $75,000 (individuals) or $150,000 (married).

- An expanded Child Tax Credit raised to $2,500 for 2025–2028.

- A deduction for interest on U.S.-made vehicle loans (no confirmed $10,000 cap).

- SALT deduction cap increased from $10k to $40k for households earning under $500k.

What’s Not in the Bill

- No repeal of taxes on Social Security benefits.

- No long-term deficit reduction: CBO estimates $3.8–$5.2 trillion increase over 10 years.

- No protection for Medicare: automatic cuts likely under the 2011 Budget Control Act.

- No new revenue mechanisms: spending cuts are insufficient to offset deficits.

Why Investors Are Concerned

- Moody’s downgraded the U.S. credit outlook due to rising debt.

- Treasury yields are climbing as investors anticipate larger deficits.

- The Senate could amend the bill to increase stimulus, worsening the deficit.

- Interest payments may rise, increasing borrowing costs and limiting policy flexibility.

Beth’s Follow-Up Question

Given all this, do you think the bill does enough to protect seniors—particularly lower- and middle-income retirees—from rising costs like healthcare, inflation, and now, tariffs?

Miles’ Reflection

It seems this bill doesn’t really benefit the people who put this administration in office. Let’s break it down—what are the actual gains (or losses) for low-income, middle-income, and high-income workers and retirees?

Beth’s Response: Who Really Gains?

Low-Income Retirees (<$25,000/year)

Gains:

- $4,000 deduction (worth ~$300–$500 in savings)

Losses:

- Still taxed on Social Security

- Medicaid/SNAP cuts likely

- Tariff-driven inflation (1–2% projected cost increases on essentials)

- Possible Medicare service reductions

Net Effect: Likely negative

Middle-Income Retirees ($25k–$80k)

Gains:

- $4,000 deduction (worth ~$480–$960)

- Increased Child Tax Credit for dependents

Losses:

- Potential out-of-pocket healthcare increases ($200+)

- Tariff-driven inflation

Net Effect: Mixed (modest tax relief may be offset by higher costs)

High-Income Retirees ($80k+)

Gains:

- Significant tax cuts (TCJA extension, estate planning)

- SALT cap raised to $40k

Losses:

- Minimal (less reliant on Medicare or subsidized programs)

Net Effect: Strongly positive

| Group | Tax Change | Healthcare Impact | Tariff Impact | Net Buying Power |

|---|---|---|---|---|

| Low-Income Retirees | Slight gain ($300–$500/yr) | Moderate loss | High loss | Decline |

| Middle-Income Workers | Modest gain ($1,000–$1,500/yr) | Speculative loss | Moderate loss | Flat or Slight Decline |

| High-Income Retirees | Large gain ($10k+/yr) | Low impact | Low impact | Increase |

Miles’ Follow-Up

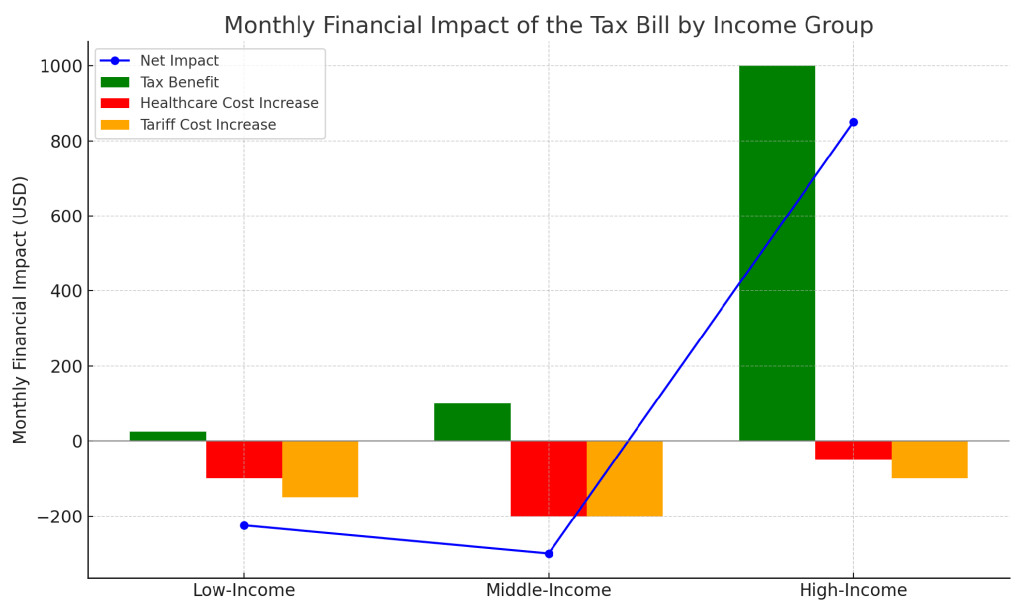

So if I understand this correctly, there is a slight benefit, but it’s outweighed by the tariffs and cuts to Medicaid. Can you show this in a graph and walk us through it?

Beth’s Graph and Walkthrough

Graph Summary

Green Bars (Tax Benefit): Modest for low/mid-income; large for high-income.

- Red Bars (Healthcare Costs): Moderate losses for low/mid-income groups.

- Orange Bars (Tariff Costs): Larger relative impact on lower-income households.

- Blue Line (Net Impact): Only high-income retirees experience clear net gains.

Conclusion:

The bill creates clear winners—and they’re not the voters facing the most financial pressure. For low- and middle-income seniors, tax cuts are more than canceled out by inflation and healthcare cost hikes.

Leave a comment